The Recession, the Rich and the Reality of the American Dream

The American public has just received news that the recession is over – and has been over for about 15 months now.

According to a statement released on Monday by the National Bureau of Economic Research, an organization composed of over 1,000 economics and business professors, the recession has been “officially” over since June of 2009.

Surprise!

Before beginning your much-belated celebration, there are several troubling thoughts that come to mind when reflecting on this statement that was just released on Monday.

For starters, the primary economic indicator used to judge whether or not we are experiencing a recession is GDP growth. If the GDP shrinks for two consecutive quarters – or 6 months – then we are officially in a recession. The National Bureau of Economic Research also uses Gross National Income, manufacturing and trade sales, and the aggregate hours of work (among other indicators) in determining that the end of our recession was June of 2009. So according to this organization, which primarily uses GDP, GNI and business output indicators to determine the duration of downturns in the business cycle, the “Great Recession” started in December of 2007 and ended in June of 2009.

Economic Policy Institute analysis

The actual report states the following: “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month.”

Which brings me to my next point: Is it a mistake to measure economic well-being by strictly following patterns of the business cycle (i.e. changes in certain economic indicators)? I understand the difference between leading indicators (stock market returns), coincident indicators (GDP) and lagging indicators (unemployment rate) in determining the economic performance, but should we continue valuing these indicators over others when measuring economic performance?

In other words, should economists place productivity measures, especially during an era of extreme wealth and income disparities, over human capital indicators? Are GDP and economic productivity numbers more indicative of the health and vitality of an economy, or are the unemployment rate, underemployment rate and poverty rate more telling signs of an economy’s well-being?

While economic growth is now positive and positively sluggard at 1.6% in the second quarter of 2010, the growth rate in the real GDP during the third quarter of 2009 was also 1.6%. It was at 5% in the fourth quarter of 2009 and 3.7% in the first quarter of 2010. The real GDP growth rate has been getting incrementally smaller for several months now and is back down to 1.6%.

Meanwhile, the unemployment rate (9.6%) remains stubbornly high and the poverty rate (14.3%) is higher than it has been since 1994. The September 17th Gallup poll indicates that the underemployment rate, or the number of citizens who are unemployed or work part-time and are looking for full-time work, is at 18.6%.

These statistics, as troublesome as they are, still fail to paint an accurate picture of the threat that this recession has created for the younger generations. According to the Economic Policy Institute, the unemployment rate for the youngest segment of workers, those Americans between the ages of 16 and 24, stood at 18.9% in January.

In my humble opinion, I think it would be prudent for our government and our many economists to reconsider the methodology used in determining our economic well-being. As is evident today, declaring the start date and end dates of recessions based on the indicators used to measure the business cycle do not take into account other, arguably more important signs of the vitality of our economy.

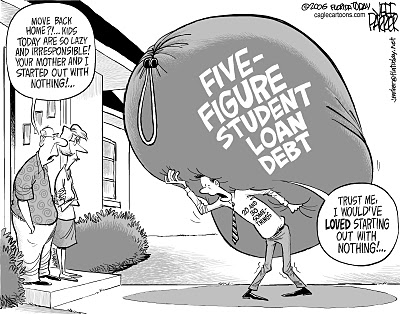

Aside from the poverty rate, unemployment and underemployment rate, and the extraordinarily large gap between the haves and have-nots, the amount of debt that younger Americans are carrying with them after graduation has increased, particularly in terms of student loans. According to the Project on Student Debt, the average debt level for seniors who graduated in 2008 stands at $23,200.00, which is 24% higher than in 2004. To put it another way, we are systematically making it more difficult for younger Americans who have decided to invest in themselves by earning college degrees to become debt-free. This means less disposable income for the educated when they start their careers, which ultimately means less demand for goods and services and, in essence, a greater likelihood that this decreased demand will result in more layoffs or less job openings at the very least.

Aside from the poverty rate, unemployment and underemployment rate, and the extraordinarily large gap between the haves and have-nots, the amount of debt that younger Americans are carrying with them after graduation has increased, particularly in terms of student loans. According to the Project on Student Debt, the average debt level for seniors who graduated in 2008 stands at $23,200.00, which is 24% higher than in 2004. To put it another way, we are systematically making it more difficult for younger Americans who have decided to invest in themselves by earning college degrees to become debt-free. This means less disposable income for the educated when they start their careers, which ultimately means less demand for goods and services and, in essence, a greater likelihood that this decreased demand will result in more layoffs or less job openings at the very least.

This is why we need to begin factoring in human capital indicators to more realistically determine the economic health of our nation.

Now it would be unfair of me to paint all millionaires and billionaires as greedy snobs who throw money into the lobbying machine to prevent their tax rates from going back up to Reagan levels. Some extremely wealthy Americans, such as Warren Buffett, have publicly voiced their opposition to their very low tax cuts. Over three years ago, Buffett told an audience at a Hillary Clinton fundraiser that he was “a Democrat because Republicans are more likely to think: ‘I’m making $80 million a year – God must have intended me to have a lower tax rate.’”

Buffett has teamed up with Bill Gates to sponsor a “Giving Pledge” initiative in which the mega-wealthy – at least 40 U.S. billionaires so far – have agreed that a substantial part of their wealth will be donated to charities during their lifetime or following their death. Although I believe that the efforts of Bill Gates, Warren Buffett and the rest of the wealthy pledgers are definitely noble to say the least, there are some critics out there who give valid reasons to remain skeptical of the effectiveness of efforts like these. For instance, Peter Wilby of The Nation offered this advice:

I repeat: we should welcome the Gates-Buffett initiative and applaud those who have joined it. Generous, public-spirited billionaires are preferable to mean ones. But remember that two-thirds of US corporations contrive to pay no federal income tax at all and that transfer pricing alone – a legal device, used, for instance, by Ellison’s Oracle Corp, that converts sales in one country to profits in another where tax liabilities are low – deprives the US treasury of $60bn annually. Such sums, which pile more taxes on the poor and reduce funds for government projects that advance the public good, dwarf what the 40 billionaires propose to give away.

In a similar type of effort, the organization United for a Fair Economy is also doing its part to address the problems that are created by the extremely low tax rates on the wealthy. This organization’s Tax Fairness Pledge allows tax payers, specifically the richest 5% of Americans, to calculate their tax savings they gained from the Bush tax cuts and “redirect those savings to support tax fairness at the national and state level.” The site also provides tax worksheets so that taxpayers can opt to redirect some of these savings towards worthy charities instead.

Another refreshing article in the news this week is an Op-Ed feature in the Los Angeles Times entitled “I’m Rich; Tax Me More” and was written by entrepreneur and venture capitalist Garrett Gruener. Gruener makes a compelling case that the trickle-down, supply-side economic policies have only benefitted the wealthy minority of Americans like himself, and disagrees with most Republicans on extending the Bush tax-cuts for the wealthy, stating that “It’s a beguiling theory, but it’s one that hasn’t worked before and won’t work now.”

He went on to share his opinion about what the U.S. Congress should do:

Instead, Congress should let the Bush tax cuts expire for the wealthiest Americans and use the additional tax revenues that are generated to invest in infrastructure and research. “Invest” is the right word. Putting money into infrastructure — such as roads, bridges, broadband, the smart grid and public transit — as well as carefully chosen research initiatives provides a foundation for future growth. As important, it puts funds in the hands of those who will spend them, generating demand that will pull us out of our economic crisis and toward a new cycle of growth.

No one particularly enjoys paying taxes, but one lesson we should have learned by now is that for the good of the country, we need to tax people like me more. At a minimum, we need to return to the tax rates of the Clinton era, when the economy performed far better. Simply taxing the wealthiest 2% of Americans at the same rates they were taxed before the Bush tax cuts could reduce the national deficit by $700 billion over the next 10 years. Remember, paying slightly more in personal income taxes won’t change my investment choices at all, and I don’t think a higher tax rate will change the investment decisions of most other high earners.

What will change my investment decisions is if I see an economy doing better, one in which there is demand for the goods and services my investments produce. I am far more likely to invest if I see a country laying the foundation for future growth. In order to get there, we first need to let the Bush-era tax cuts for the upper 2% lapse. It is time to tax me more.

While it is encouraging that an increasing number of rich Americans are beginning to see the systemic risk of income and wealth inequalities created by our tax policies, it seems as though there is no significant grassroots movement that advances fair taxation reform in today’s political environment. Instead of a populist grassroots movement demanding more government action to create jobs and to implement a more progressive tax code, a much different movement has recently emerged. This movement is called the tea party and has been advanced by figures such as Glenn Beck, Sarah Palin, Jim DeMint and Newt Gingrich (just to name a few). This extremely conservative and corporate-financed movement’s stated goals are to get the government out of the private sector all together, abolish major government programs and work towards privatizing nearly everything – including Social Security and the Department of Education.

Department of Education.

What is most surprising to me is that there is no tangible movement akin to the tea party but that comes from a more leftist or at least an increased Keynesian economic approach – such as increased deficit spending to create more jobs – with goals that are quite the opposite of the tea party’s goals (according to a recent CBS poll).

If you missed President Obama’s town hall forum on CNBC, there were quite a few well-constructed questions and concerns raised by middle-class Americans (get transcript here).

One member of the audience, a female African-American U.S. veteran and CFO for a Veteran Service Organization, AmVets, was very blunt with the President, stating:

I am a chief financial officer for a veterans service organization, AmVets here in Washington. I’m also a mother, I’m a wife, I’m an American veteran, and I’m one of your middle-class Americans. And quite frankly, I’m exhausted. I’m exhausted of defending you, defending your administration, defending the mantle of change that I voted for and deeply disappointed with where we are right now. I have been told that I voted for a man who said he was going to change things in a meaningful way for the middle class. I’m one of those people, and I’m waiting, sir. I’m waiting. I don’t feel it yet. And I thought, while it wouldn’t be in great measure, I would feel it in some small measure.

Another audience member, a recent law school graduate, had this to say:

I’m 30 years old. I recently graduated from law school. And I went back to law school in order to pursue a life of public service, like you have. And what I found was that I simply — there aren’t jobs out there right now. I took advantage of the loans that you were just speaking about, but I can’t make the interest payments on those loans today, let alone think about getting a mortgage, having a family, having even a marriage — it’s awfully expensive. Like a lot of people in my generation, I was really inspired by you and by your campaign and message that you brought, and that inspiration is dying away. It feels like the American Dream is not attainable to a lot of us. And what I’m really hoping to hear from you is several concrete steps that you’re going to take moving forward that will be able to re-ignite my generation, re-ignite the youth who are beset by student loans. And I really want to know, is the American Dream dead for me?

Statements and questions like these represent the genuine concerns that most middle-class Americans are now confronting in our current economic “recovery.” These concerns have not been granted enough attention by the mainstream media, especially in comparison to the tea party movement.

It is unlikely that a more progressive populist movement will emerge before the midterm elections. Ironically enough, the two individuals with the most potential to muster enough support for such a movement are none other than Comedy Central’s Jon Stewart and Stephen Colbert, who are staging competing public events at the National Mall in Washington D.C. on October 30th. This shared event – Stewart’s “Rally to Restore Sanity” and Colbert’s “March to Keep Fear Alive” – can be described as a rebuttal to the rise of right-wing extremists Glenn Beck and Sarah Palin, who recently hosted their own tea party event in front of the Lincoln Memorial, called the “Restoring Honor” rally.

As comforting as comedy can make us feel in times of economic uncertainty, now is not the time to sit back and hope that the influence of comedians or the philanthropic actions of well-meaning billionaires will effectively carry through a much-needed progressive agenda for middle class America. Without an organized base from the bottom up, the prospect for progressive reform will inevitably result in a tragedy – most likely caused by the well-funded Tea Party/Republican agenda.

Rally to Restore Sanity

March to Keep Fear Alive

The Recession, the Rich and the Reality of the American Dream

09/22/2010 Leave a comment

The American public has just received news that the recession is over – and has been over for about 15 months now.

According to a statement released on Monday by the National Bureau of Economic Research, an organization composed of over 1,000 economics and business professors, the recession has been “officially” over since June of 2009.

Surprise!

Before beginning your much-belated celebration, there are several troubling thoughts that come to mind when reflecting on this statement that was just released on Monday.

For starters, the primary economic indicator used to judge whether or not we are experiencing a recession is GDP growth. If the GDP shrinks for two consecutive quarters – or 6 months – then we are officially in a recession. The National Bureau of Economic Research also uses Gross National Income, manufacturing and trade sales, and the aggregate hours of work (among other indicators) in determining that the end of our recession was June of 2009. So according to this organization, which primarily uses GDP, GNI and business output indicators to determine the duration of downturns in the business cycle, the “Great Recession” started in December of 2007 and ended in June of 2009.

Economic Policy Institute analysis

The actual report states the following: “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month.”

Which brings me to my next point: Is it a mistake to measure economic well-being by strictly following patterns of the business cycle (i.e. changes in certain economic indicators)? I understand the difference between leading indicators (stock market returns), coincident indicators (GDP) and lagging indicators (unemployment rate) in determining the economic performance, but should we continue valuing these indicators over others when measuring economic performance?

In other words, should economists place productivity measures, especially during an era of extreme wealth and income disparities, over human capital indicators? Are GDP and economic productivity numbers more indicative of the health and vitality of an economy, or are the unemployment rate, underemployment rate and poverty rate more telling signs of an economy’s well-being?

While economic growth is now positive and positively sluggard at 1.6% in the second quarter of 2010, the growth rate in the real GDP during the third quarter of 2009 was also 1.6%. It was at 5% in the fourth quarter of 2009 and 3.7% in the first quarter of 2010. The real GDP growth rate has been getting incrementally smaller for several months now and is back down to 1.6%.

Meanwhile, the unemployment rate (9.6%) remains stubbornly high and the poverty rate (14.3%) is higher than it has been since 1994. The September 17th Gallup poll indicates that the underemployment rate, or the number of citizens who are unemployed or work part-time and are looking for full-time work, is at 18.6%.

These statistics, as troublesome as they are, still fail to paint an accurate picture of the threat that this recession has created for the younger generations. According to the Economic Policy Institute, the unemployment rate for the youngest segment of workers, those Americans between the ages of 16 and 24, stood at 18.9% in January.

In my humble opinion, I think it would be prudent for our government and our many economists to reconsider the methodology used in determining our economic well-being. As is evident today, declaring the start date and end dates of recessions based on the indicators used to measure the business cycle do not take into account other, arguably more important signs of the vitality of our economy.

This is why we need to begin factoring in human capital indicators to more realistically determine the economic health of our nation.

Now it would be unfair of me to paint all millionaires and billionaires as greedy snobs who throw money into the lobbying machine to prevent their tax rates from going back up to Reagan levels. Some extremely wealthy Americans, such as Warren Buffett, have publicly voiced their opposition to their very low tax cuts. Over three years ago, Buffett told an audience at a Hillary Clinton fundraiser that he was “a Democrat because Republicans are more likely to think: ‘I’m making $80 million a year – God must have intended me to have a lower tax rate.’”

Buffett has teamed up with Bill Gates to sponsor a “Giving Pledge” initiative in which the mega-wealthy – at least 40 U.S. billionaires so far – have agreed that a substantial part of their wealth will be donated to charities during their lifetime or following their death. Although I believe that the efforts of Bill Gates, Warren Buffett and the rest of the wealthy pledgers are definitely noble to say the least, there are some critics out there who give valid reasons to remain skeptical of the effectiveness of efforts like these. For instance, Peter Wilby of The Nation offered this advice:

In a similar type of effort, the organization United for a Fair Economy is also doing its part to address the problems that are created by the extremely low tax rates on the wealthy. This organization’s Tax Fairness Pledge allows tax payers, specifically the richest 5% of Americans, to calculate their tax savings they gained from the Bush tax cuts and “redirect those savings to support tax fairness at the national and state level.” The site also provides tax worksheets so that taxpayers can opt to redirect some of these savings towards worthy charities instead.

Another refreshing article in the news this week is an Op-Ed feature in the Los Angeles Times entitled “I’m Rich; Tax Me More” and was written by entrepreneur and venture capitalist Garrett Gruener. Gruener makes a compelling case that the trickle-down, supply-side economic policies have only benefitted the wealthy minority of Americans like himself, and disagrees with most Republicans on extending the Bush tax-cuts for the wealthy, stating that “It’s a beguiling theory, but it’s one that hasn’t worked before and won’t work now.”

He went on to share his opinion about what the U.S. Congress should do:

While it is encouraging that an increasing number of rich Americans are beginning to see the systemic risk of income and wealth inequalities created by our tax policies, it seems as though there is no significant grassroots movement that advances fair taxation reform in today’s political environment. Instead of a populist grassroots movement demanding more government action to create jobs and to implement a more progressive tax code, a much different movement has recently emerged. This movement is called the tea party and has been advanced by figures such as Glenn Beck, Sarah Palin, Jim DeMint and Newt Gingrich (just to name a few). This extremely conservative and corporate-financed movement’s stated goals are to get the government out of the private sector all together, abolish major government programs and work towards privatizing nearly everything – including Social Security and the Department of Education.

Department of Education.

What is most surprising to me is that there is no tangible movement akin to the tea party but that comes from a more leftist or at least an increased Keynesian economic approach – such as increased deficit spending to create more jobs – with goals that are quite the opposite of the tea party’s goals (according to a recent CBS poll).

If you missed President Obama’s town hall forum on CNBC, there were quite a few well-constructed questions and concerns raised by middle-class Americans (get transcript here).

One member of the audience, a female African-American U.S. veteran and CFO for a Veteran Service Organization, AmVets, was very blunt with the President, stating:

Another audience member, a recent law school graduate, had this to say:

Statements and questions like these represent the genuine concerns that most middle-class Americans are now confronting in our current economic “recovery.” These concerns have not been granted enough attention by the mainstream media, especially in comparison to the tea party movement.

It is unlikely that a more progressive populist movement will emerge before the midterm elections. Ironically enough, the two individuals with the most potential to muster enough support for such a movement are none other than Comedy Central’s Jon Stewart and Stephen Colbert, who are staging competing public events at the National Mall in Washington D.C. on October 30th. This shared event – Stewart’s “Rally to Restore Sanity” and Colbert’s “March to Keep Fear Alive” – can be described as a rebuttal to the rise of right-wing extremists Glenn Beck and Sarah Palin, who recently hosted their own tea party event in front of the Lincoln Memorial, called the “Restoring Honor” rally.

As comforting as comedy can make us feel in times of economic uncertainty, now is not the time to sit back and hope that the influence of comedians or the philanthropic actions of well-meaning billionaires will effectively carry through a much-needed progressive agenda for middle class America. Without an organized base from the bottom up, the prospect for progressive reform will inevitably result in a tragedy – most likely caused by the well-funded Tea Party/Republican agenda.

Rally to Restore Sanity

March to Keep Fear Alive

Rate this:

Share this:

Related

Filed under Commentary Tagged with Business cycle, CNBC Town Hall, Economic growth, Economic Policy Institute, Garrett Gruener, Giving Pledge, Great Recession, Gross domestic product, Gross National Income, Human capital, Jon Stewart, March to Keep Fear Alive, National Bureau of Economic Research, President Obama, Rally to Restore Sanity, Stephen Colbert, Tax Fairness Pledge, Unemployment, United for a Fair Economy